The Four Jars System That Made My Kids Stop Begging for Toys

We were in Target store. Again.

My 10-year-old daughter spotted a craft supply set—$59.99, some elaborate DIY kit she apparently couldn’t live without.

“Dad, can we get this? Please? I NEED it.”

I’d heard this 47 times that week. Every store, every commercial, every friend’s birthday party sparked a new “need.” My wallet was exhausted. My patience was thinner.

But this time, something was different.

Before I could launch into my usual “We’re not buying that today” speech, my son—15 years old—looked at his sister and said:

“Do you have enough in your Save Jar?”

She paused. Actually thought about it. Then said, “No. But I get my allowance on Saturday. I could save for two weeks and buy it myself.”

And just like that, we left Target. No tantrum. No begging. No battle.

She didn’t get the craft set that day. But she got something infinitely more valuable: she learned that wanting something and being able to afford it are two different things.

That moment? That’s what the Four Jars System does.

The Target Meltdown That Changed Everything

Let me rewind to eight weeks ago, before the Four Jars System, when every shopping trip was a negotiation.

Sarah (yes, the same Sarah from last week’s Problem-Solving post) called me after a particularly brutal Target run. Her 8-year-old had a full meltdown in the toy aisle. Screaming. Crying. Other parents staring and she was so upset and could not figure out what to do and rush away from the store.

“He thinks money just appears,” she told me. “He has no concept that we work for it, that there are limits, that choices have consequences. And I realized—I never taught him. I just kept saying ‘no’ without explaining why.”

The Wilsons had a different problem. Their three kids (7, 9, and 11) fought constantly over who got what. “It’s not fair!” was the household motto. Every purchase was a comparison, a competition, a source of resentment.

The Nguyens’ 6-year-old twins? They thought money grew on trees. Literally asked their dad if he could “just go pick some more money” when he said they couldn’t afford something.

These aren’t bad kids. These are normal kids growing up in a world where:

- Money is invisible (everything’s digital)

- Spending is instant (one-click purchases)

- Wants feel like needs (advertising is everywhere)

- Schools teach algebra but not budgeting

And here’s what terrifies me: My kids will graduate high school knowing the quadratic formula but not how to balance a checkbook. They’ll study Shakespeare but not compound interest. They’ll memorize the periodic table but not understand credit card debt.

My 15-year-old son is three years away from college. He needs to understand student loans, credit cards, budgeting for dorm life. And my 10-year-old daughter is already navigating online shopping, in-app purchases, and peer pressure to buy the latest trends.

So Sarah, the Wilsons, the Nguyens, and I decided to do something about it.

We created the Four Jars System.

What Is the Four Jars System?

It’s exactly what it sounds like: four clear jars (or containers) that sit somewhere visible in your house. Each jar has a purpose. Each jar teaches a different financial principle.

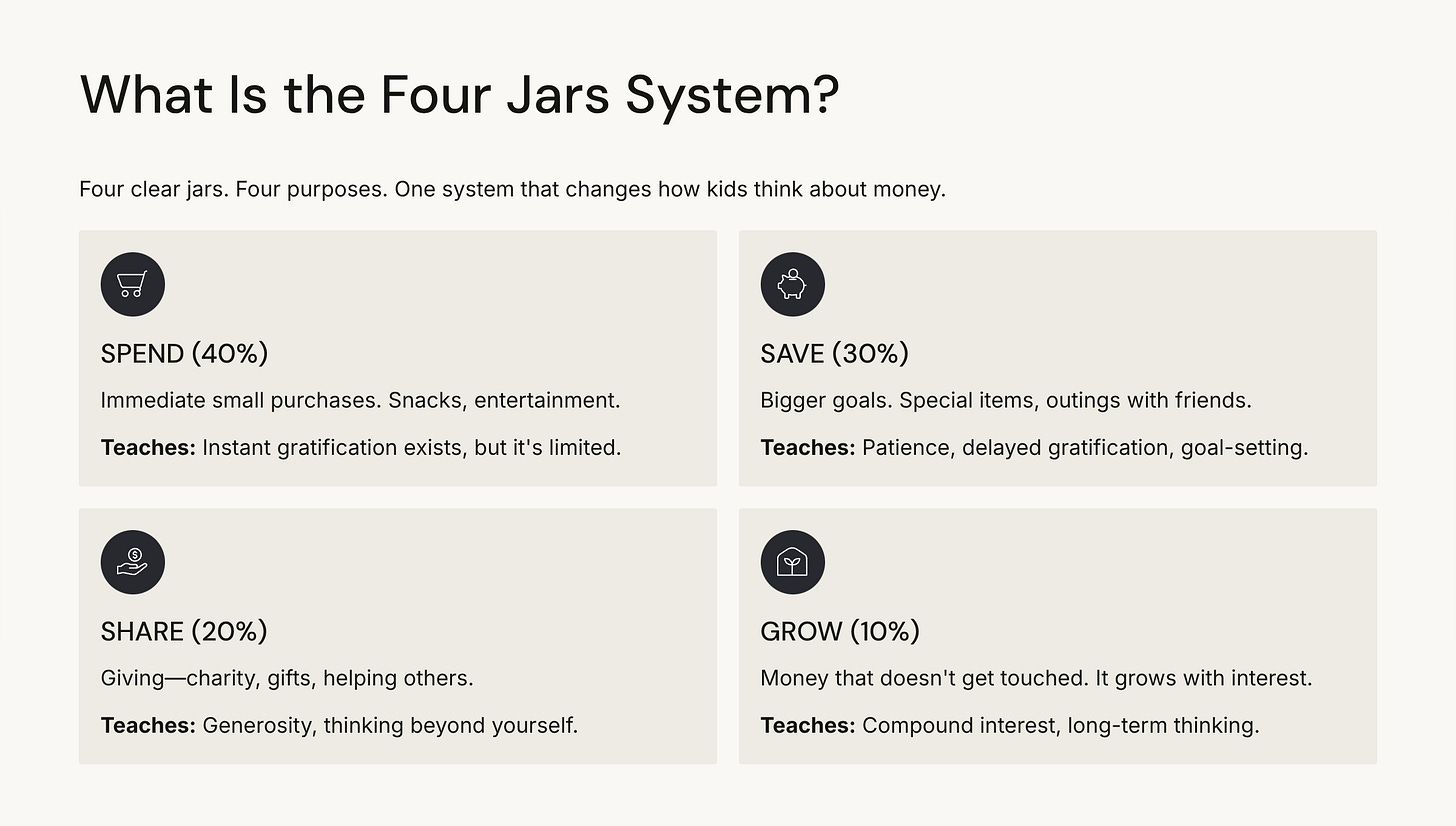

Here’s the breakdown:

Jar 1: SPEND (40%) Money for immediate small purchases. Snacks, small items, entertainment. Teaches: instant gratification exists, but it’s limited.

Jar 2: SAVE (30%) Money for bigger goals. That $60 craft set, new headphones, a special outing with friends. Teaches: patience, delayed gratification, goal-setting.

Jar 3: SHARE (20%) Money for giving—charity, gifts for others, helping someone in need. Teaches: generosity, thinking beyond yourself, the joy of giving.

Jar 4: GROW (10%) Money that doesn’t get touched. It grows. (For younger kids, you add interest. For teens, it goes into a real savings account.) Teaches: compound interest, long-term thinking, making money work for you.

That’s it. Four jars. Four concepts. One system that changes how kids think about money.

The First Week: What Actually Happened

Let me be honest: Week 1 wasn’t magical. It was messy, confusing, and full of questions.

My family, Day 1:

I set up the jars on Saturday morning with my two kids (10 and 15). Explained the system. Handed out the weekly allowance: $20 for my daughter, $30 for my son (based on age).

My 10-year-old daughter immediately: “So I can take all my Spend money and buy something today?”

Me: “Yep! That’s your $8. You can spend it however you want.”

My daughter: “But then I’ll have zero dollars in Spend.”

Me: “Yep. And then you’ll wait until next Saturday for more.”

The look on her face. The sudden realization that her choices had consequences. That was worth everything.

My 15-year-old son was skeptical at first: “Dad, I’m too old for this.” But when he calculated his Grow jar could reach $150 in a year with interest? He was in.

Sarah’s family, Day 1:

She set up the jars on Saturday morning with her two kids (6 and 8). Explained the system. Handed out the weekly allowance: $12 for the 6-year-old, $16 for the 8-year-old.

Her 8-year-old immediately: “So I can take all my Spend money and buy something today?”

Sarah: “Yep! That’s your $6.40. You can spend it however you want.”

Her son: “But then I’ll have zero dollars in Spend.”

Sarah: “Yep. And then you’ll wait until next Saturday for more.”

The look on his face. The sudden realization that his choices had consequences. That was worth everything.

The Wilson family, Day 3:

Their 7-year-old wanted a toy that cost $16. He had $6.40 in his Save jar.

Instead of the usual begging, he asked: “How many weeks until I have enough?”

They did the math together. Four more weeks of saving $3 each week.

He made a chart. Taped it to the fridge. Started crossing off weeks.

The toy wasn’t the win. The planning was the win.

The Nguyen family, Day 5:

One twin wanted to buy candy. The other twin said, “But if you don’t buy candy for three weeks, you can get that big Batman toy you wanted.”

A six-year-old. Teaching his brother. About delayed gratification.

Their dad texted me: “Did my kid just become a financial advisor?”

Why Four Jars Instead of Just “Savings”?

Because real adult financial life isn’t just about saving. It’s about balancing multiple competing priorities.

We don’t just save money. We:

- Spend some (bills, necessities, small pleasures)

- Save some (emergency fund, big purchases)

- Give some (charity, gifts, helping others)

- Invest some (retirement, making money grow)

The Four Jars System teaches kids the same framework adults use—but at a level they can see, touch, and understand.

When my daughter sees her jars, she sees her choices:

- “I could spend this on snacks now, OR save it toward that craft set.”

- “I could save faster if I spend less this week.”

- “I have enough to share—I want to donate to the animal shelter.”

When my 15-year-old son sees his jars, he’s learning concepts he’ll need in three years:

- “If I can save $30/month now, I’ll understand how to budget in college.”

- “This Grow jar is basically my first investment account.”

- “I’m learning to balance wants vs. needs before I have a credit card.”

These are the exact thought patterns financially intelligent adults use every day.

And they’re learning them at 10 and 15 years old.

The Questions You’re Probably Asking

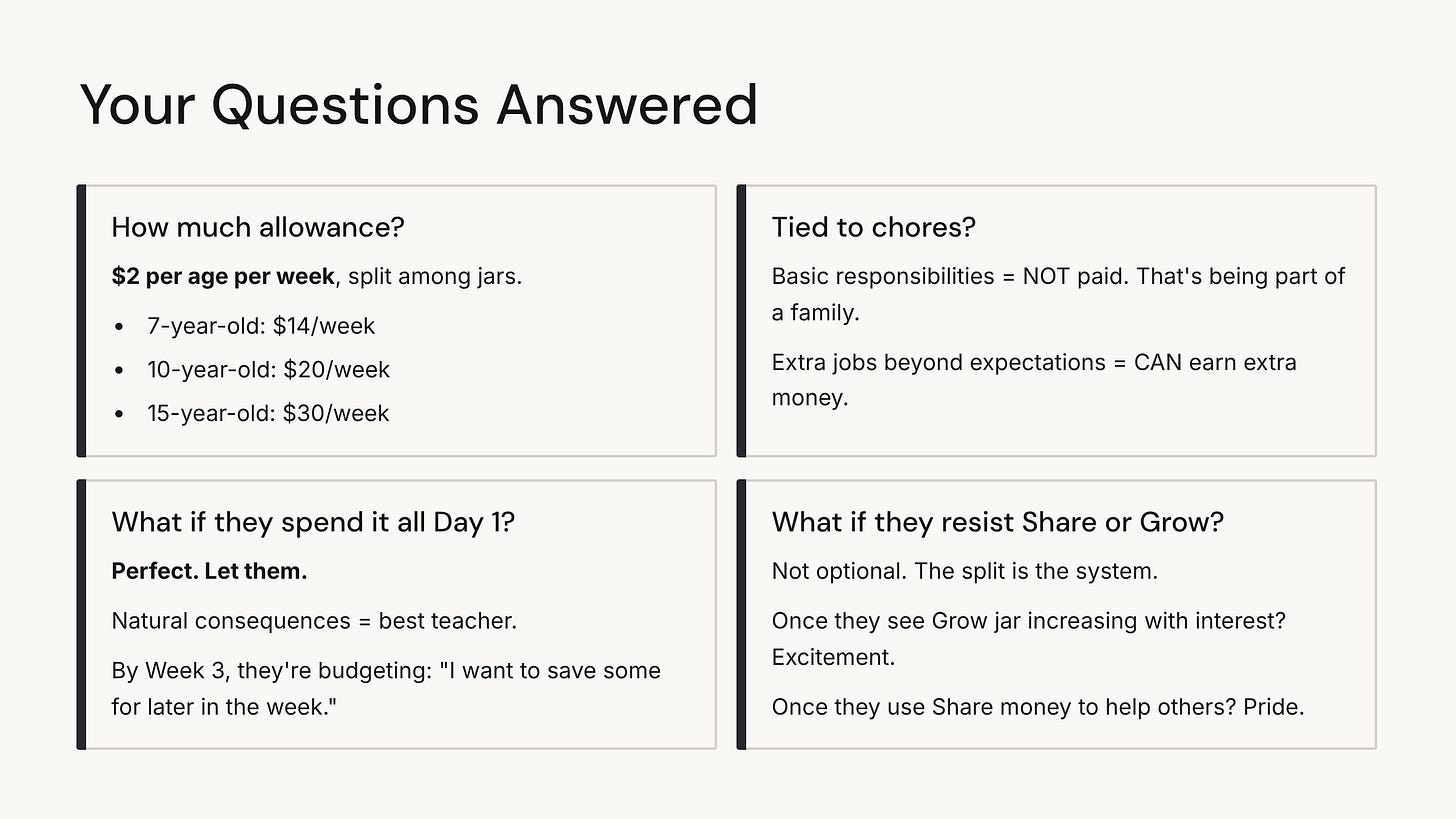

“How much allowance should I give?”

We tested different amounts. The magic formula: $2 per age per week, split among the jars.

So a 7-year-old gets $14/week:

- Spend: $5.60, Save: $4.20, Share: $2.80, Grow: $1.40

A 10-year-old gets $20/week:

- Spend: $8, Save: $6, Share: $4, Grow: $2

A 15-year-old gets $30/week:

- Spend: $12, Save: $9, Share: $6, Grow: $3

“Should allowance be tied to chores?”

This sparked major debate among our test families. Here’s what we landed on:

Basic life responsibilities (make bed, clear dishes, help with family stuff) = NOT paid. That’s being part of a family.

Extra jobs beyond basic expectations (wash car, organize garage, help with big projects) = CAN earn extra money.

Why? Because in real life, you don’t get paid for brushing your teeth or doing laundry. But you CAN earn more by doing extra work.

My 15-year-old son mows the lawn for extra cash. My 10-year-old daughter helps organize the garage. They’re learning that more effort = more income.

“What if they spend all their Spend money on Day 1?”

PERFECT. Let them.

Then when they want something on Day 3, you say: “Do you have money in your Spend jar?”

“No.”

“Then we wait until Saturday.”

Natural consequences. The best teacher.

My daughter blew through her Spend money in the first week. By Week 3? She was budgeting. “I want to save some Spend money for later in the week just in case.”

“What if they never want to put money in Share or Grow?”

Not optional. The split is the system.

But here’s what happened: Once my son saw his Grow jar increasing (I added 10% “interest” monthly), he got EXCITED about it. He started asking about real investment accounts.

And once my daughter used Share money to buy supplies for a school fundraiser? The pride on her face was worth more than any amount of money.

The Real Change: It’s Not About the Money

Here’s what I didn’t expect:

The Four Jars System didn’t just change how my kids handle money. It changed how they think about choices, consequences, and future planning.

My 10-year-old daughter now:

- Thinks before asking for things

- Understands trade-offs (”If I buy this, I can’t buy that”)

- Plans ahead (makes lists of what she’s saving toward)

- Feels proud of her decisions

- Understands that resources are limited

My 15-year-old son now:

- Asks about how credit cards work

- Wants to understand student loans before college

- Thinks about opportunity cost (”If I spend $12 on fast food, that’s four weeks of Grow money”)

- Plans for bigger purchases weeks in advance

- Actually understands why budgeting matters

These aren’t money skills. These are life skills.

The Wilson family’s 11-year-old daughter started applying the jar logic to her time: “I only have so many hours after school. If I spend two hours on my phone, I don’t have time for soccer practice and homework. It’s like my time jars.”

The Nguyen twins (6 years old!) started understanding that their parents’ money came from working. Not from magical ATMs or “just getting more.”

And Sarah’s kids? They stopped begging. Actually stopped. Because they knew the answer: “Do you have money in your jar? No? Then you’re saving for it or you’re waiting.”

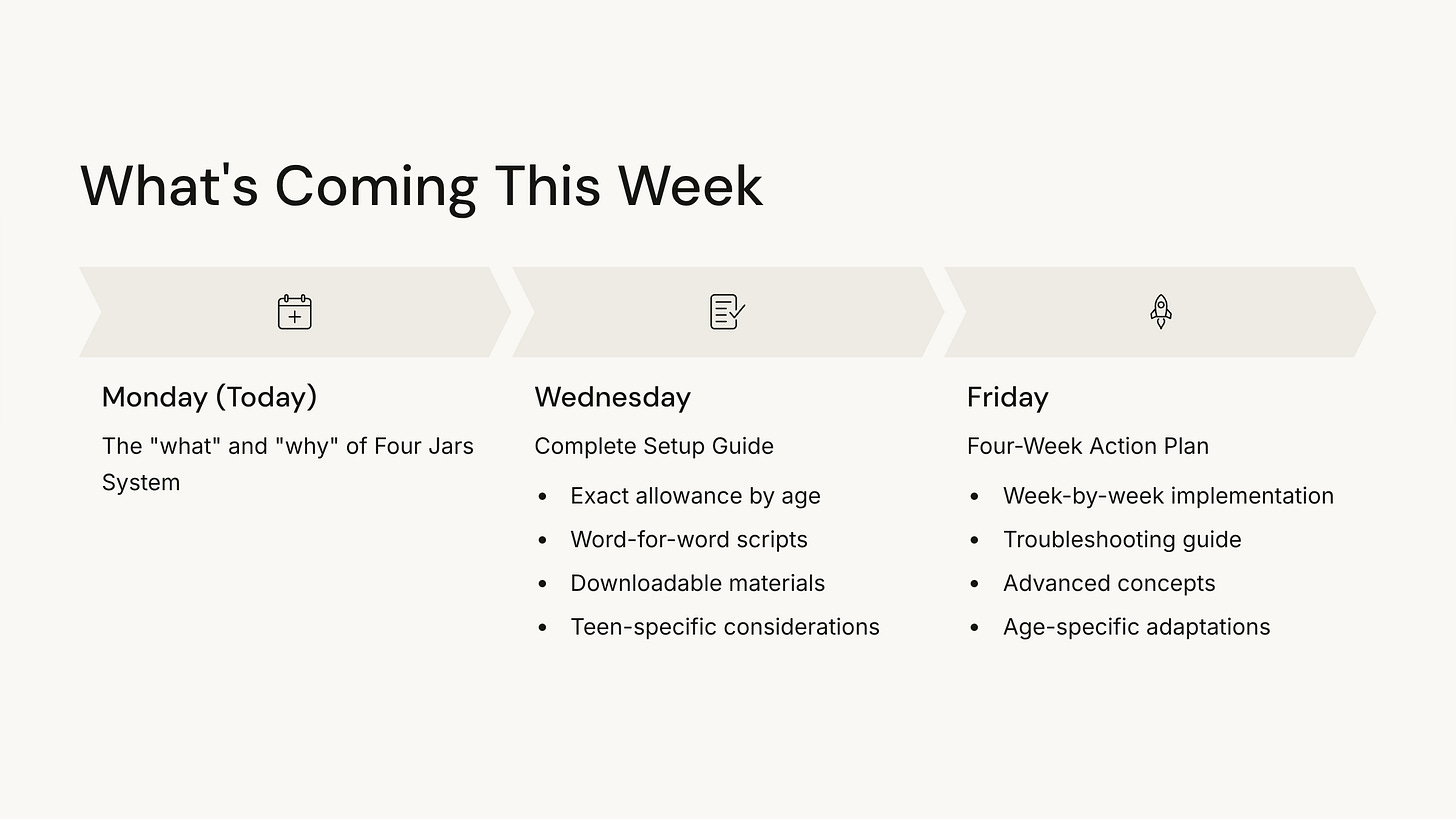

What’s Coming This Week

This Monday post is your snapshot—the “what” and “why” of the Four Jars System.

But if you want the “how”—the exact implementation guide, the scripts for every tough conversation, the age-by-age breakdown, the downloadable materials—that’s coming Wednesday and Friday for paid subscribers.

Your Starting Line

If you take one action today, before Wednesday’s detailed guide drops, here it is:

Find four clear containers. Label them: Spend, Save, Share, Grow.

That’s it. Just set them up somewhere your kids can see them.

At dinner tonight, tell your kids: “We’re trying something new with money. I’m going to teach you what schools don’t: how to actually handle money in real life.”

Watch their faces light up.

Because here’s what I’ve learned over these eight weeks with the Four Jars System:

Kids WANT to learn about money. They want to feel competent. They want to make choices. They want to understand the adult world they’re growing into.

My 15-year-old told me last week: “Dad, I’m glad we’re doing this before I go to college. Most of my friends have no idea how money actually works.”

My 10-year-old said: “I like knowing how much I have. It makes me feel like a grown-up.”

We’re not teaching them to be greedy. We’re teaching them to be intentional.

We’re not teaching them that money is everything. We’re teaching them that money is a tool—and tools work better when you know how to use them.

And we’re not waiting for schools to figure this out. We’re teaching them ourselves, starting this week, with four simple jars on the kitchen counter.

LEAVE A COMMENT